Nvidia’s Rise: Surpassing Nations, Dominating AI Infrastructure

- Sena Aslıhan

- Jul 21, 2025

- 2 min read

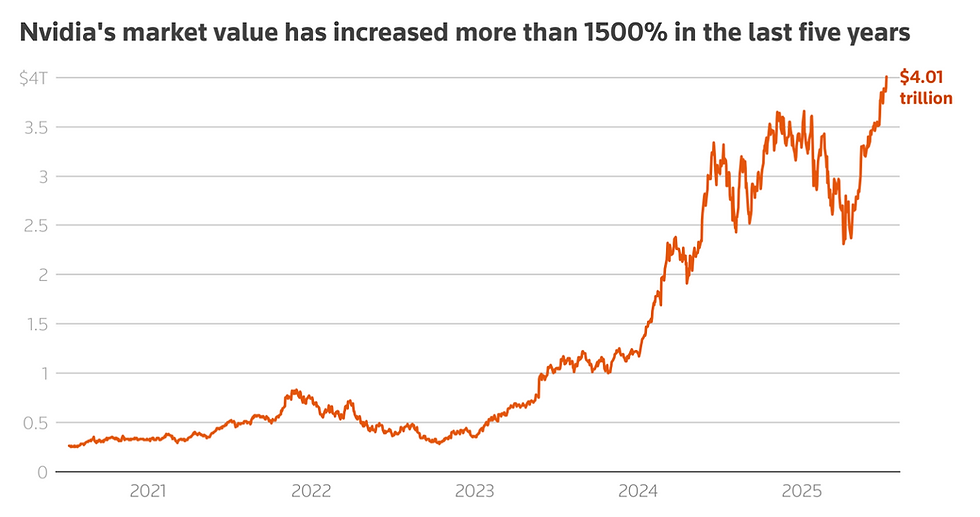

Nvidia has officially become the first publicly traded company in history to exceed $4 trillion in market value, driven by the great global demand for its technological products related to artificial intelligence, chips, and accelerated computing. As of July 9, 2025, its share price stands at approximately $164, surpassing the values of well-known Samsung and Apple.

This rapidly increasing value also highlights the growth of artificial intelligence and the rise of chip and microchip usage—which are thought to be the backbones of further technological developments. As Robert Pavlik, senior portfolio manager at Dakota Wealth, told Reuters, “It highlights the fact that companies are shifting their asset spend in the direction of AI, and it’s pretty much the future of technology.” This demonstrates that both corporate and individual investment trends are increasingly shaped by artificial intelligence.

This significant milestone came only two years after hitting the $1 trillion mark; since 2023, the firm’s value has skyrocketed, seeing explosive 287% growth. The company was competing against firms Apple and Microsoft in the race to reach a $4 trillion value.

The co-founder and CEO of NVIDIA told the investors in a May conference call that the “global demand for NVIDIA’s artificial intelligence infrastructure is incredibly strong,” to underscore the success once again.

This record comes as the great firms in the field of technology, like OpenAI, Amazon, and Microsoft, are investing heavily to build massive data centers in line with artificial intelligence developments. The key point is that all of these companies currently rely on NVIDIA chips to power their services, even though some, such as Apple and Google, have begun developing their own. While this underscores NVIDIA’s success, it also signals the potential competition as major tech firms explore alternatives to reduce dependence on external suppliers.

A notable fact about NVIDIA’s market cap surpassing the $4 trillion mark is that its value is higher than some large countries’ entire stock markets, such as Canada and the United Kingdom, while being slightly smaller than Hong Kong and making up around one-third of the size of publicly traded companies in China.

To employ a connection to Türkiye, NVIDIA’s value is 10 times greater than Türkiye’s total market capitalization of $0.4 trillion, ranking 32nd globally.

Given its low market value, it is worth noting that Türkiye's chip industry remains in its early stages, with limited development to date. At the beginning of 2025, Ermaksan established the first chip manufacturing facility; however, as it is new, the sector has yet to witness any significant advancements.

NVIDIA’s $4 trillion market capitalization is a milestone in both global financial markets and the evolution of technology. As a leading supplier of high-performance chips that solidify artificial intelligence infrastructure worldwide, the company’s rapid growth showcases the increased demand for AI capabilities across industries.

Edited by: Ömer Gökce